“Opportunity zones are the hottest new investment opportunity in America.”

- Forbes Magazine

There are significant tax benefits to investments located within an Opportunity Zone.

Sage Equities is pioneering Opportunity Zone investments in Bakersfield, California.

All of our multifamily developments are located within Qualified Opportunity Zones, which allows us to offer significant tax benefits to our investors. A central feature of the federal program is the revitalization of communities through the creation of social and economic opportunity. At Sage, we are doing just that 一 working to redevelop the Eastchester neighborhood in Downtown Bakersfield through high-quality, recession-resilient residential projects.

Created through the Tax Cuts and Jobs Act passed in December 2017, Opportunity Zones offer investors the ability to place realized capital gains into real estate projects and businesses in qualified geographical areas. Sage is able to offer these significant, once-in-a-lifetime tax benefits to investors since we develop ground-up multifamily residential structures located in Qualified Opportunity Zones in Downtown Bakersfield, California.

With this program, investors who hold capital gains due to recent capital events, such as an inheritance or the divesting of a stock, property or a business, can both defer and reduce their tax liability by reinvesting their capital gains in a new type of investment vehicle called an Opportunity Zone Fund.

It took dozens of local investors partnering with us to complete these developments. We are grateful to them every day and work diligently to maximize the return on their investments.

Locating our properties inside a Qualified Opportunity Zone has been key.

The federal Tax Cuts and Jobs Act of 2017 created an economic development tool known as “opportunity zones”. The program is designed to encourage long-term investments in revitalizing areas. The goal is to get capital to these emerging census tracts. The program gives patient investors and developers significant tax incentives in exchange for long-term investment in these zones.

Why Bet on Bakersfield?

There is a quickly growing movement brewing in the interior of America, and Bakersfield is at the heart of it.

Since the pandemic, the Bakersfield economy has grown and thrived. Bakersfield’s population has increased at a higher rate than any of the other ten largest cities in California (State of CA Department of Finance).

Contributing factors:

Accessibility of remote work: many professionals can move anywhere

High quality of life: attracts new residents from outside Bakersfield

Hunger for authenticity: original culture (music, food, architecture), welcoming residents, walkable downtown, outdoor amenities

Opportunity Zone 2.0 solidifies the program’s future, shifting focus towards deeper impact and greater transparency.

While the core tax benefits remain attractive, the rules of engagement have evolved.

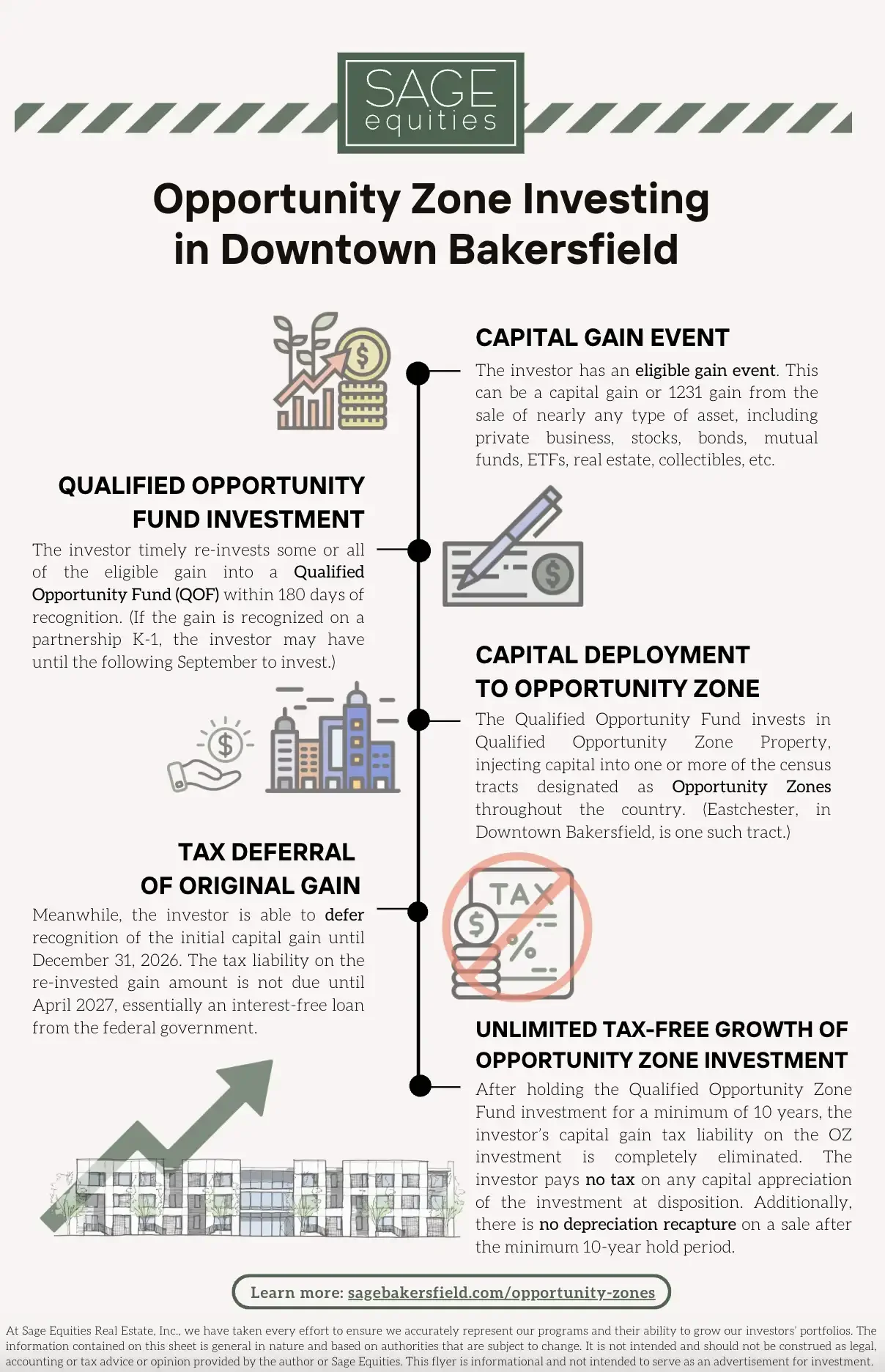

How does Opportunity Zone Fund investing work?

Tax Benefits of Opportunity Zone Funds

This map depicts the Opportunity Zone in Downtown Bakersfield, California. All of our multifamily developments are located within the Eastchester neighborhood in this Qualified Opportunity Zone.

An investor who has realized a capital gain by selling an asset like stocks or real estate can receive special tax benefits if they reinvest that gain into an Opportunity Fund within 180 days.

There are three primary advantages to rolling over a capital gain into an Opportunity Zone Fund:

Temporary Deferral

Capital gains from the sale of any asset (if reinvested in 180 days) are deferred until the sale of the new investment, or December 31, 2026, whichever is earlier.

Step-up Basis

Any investment re-invested and held for 5 years gets a tax basis increase of 10%, and any investment held for 7 years gets a tax basis increase of 15%.

Permanent Exclusion

Investments held for 10 years will pay no capital gains tax on the post acquisition gains. This permanent exclusion applies only to the gains accrued in the OZ Fund.

Sage co-owner, Anna Smith, wrote about Opportunity Zone investments in her business column for The Bakersfield Californian. You can find links to her articles below:

Meet me at Stanford: Attending an Opportunity Zone Investor Summit

Opportunity Zones Provide Chance to Increase Private Investment in our Community

References

FAQs for Opportunity Zones (Internal Revenue Service)

Opportunity Zones: A New Tool for Community Development (Novogradac & Co.)

Disclaimer: When addressing investments through Sage Equities Real Estate Inc., we’ve taken every effort to ensure we accurately represent our programs and their ability to grow our investors’ portfolios. The information contained on this website is general in nature and based on authorities that are subject to change. It is not intended and should not be construed as legal, accounting or tax advice or opinion provided by the author or Sage Equities.

This site is not intended to serve as an advertisement for investment.

Sage Equities makes no representations or warranties regarding the suitability for any purpose of, the accuracy, the completeness, or the timeliness of any information provided in this website.

Sage Equities is not responsible for the content of any other website or third party content accessible through this web site via hyperlink or other transmission